Exchange-Traded Funds are the Smarter Way to Invest

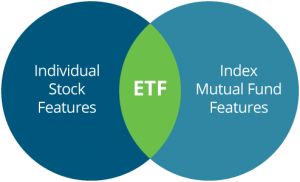

First introduced in 1993, Exchange-Traded Funds (ETFs) are rapidly becoming the investment tool of choice for millions of investors. ETFs allow investors to easily implement a wide range of investment strategies from the most basic to the most sophisticated. Today, there are over 3,400 different ETFs with total assets exceeding $9 trillion making ETFs the fastest growing investment product in the history of Wall Street. On an average day, ETFs account for over 1/3 of all trading volume on the New York Stock Exchange.